- Access loans starting from GHS 50,000.00, catering to various business financing needs.

- Flexible Repayment Structures

- Timely Offer Letters

- Competitive Interest Rates

- Flexible credit structuring

B A N K

Term Loans

Fueling your goals, one step at a time.

Term Loans are structured credit facilities designed to provide fixed asset and working capital support for small, medium, and corporate businesses. This financing option helps businesses acquire essential assets or manage cash flow needs effectively.

-

Features & Benefits

-

Requirements

- Processing Fee payments up to 3.5%

- A default charge of 10% per annum applies to any overdue balance of principal and interest.

- The interest rate is set at GRR + up to 15%, ensuring a competitive borrowing cost.

- Borrowers must maintain an open current account

- Completed credit application forms.

- Minimum 6 months of bank statements.

- Investment Plan

- Financial Documentation:

- Proposed Security/Collateral:

General Products & Services

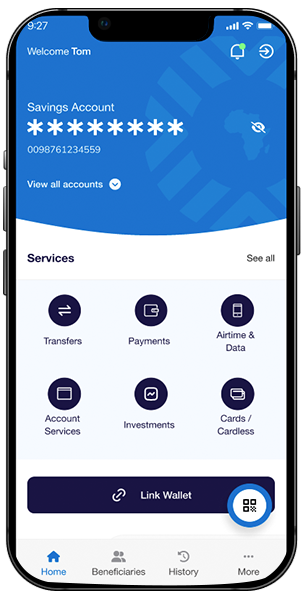

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I use four banks but OmniBSIC Bank is my favorite out of all four and I like all the feedback too. God should grant you more customers.”

“The Tellers, CSOs, and everyone at OmniBSIC Bank are exceptional. You bring a cheque, and they process it instantly. Need a transfer to another bank? They handle it within 30 minutes—no delays ”

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”

“So far, the experience has been fantastic, with excellent customer service. They greet customers with warm smiles, and the tellers are attentive and efficient, welcoming you with a friendly approach. It’s truly been amazing”

“The customer service is good and I recommend OmniBSIC Bank to everybody.”