- Advance Amount: up to 75% of their one-month salary (net of tax and all other deductions), with a cap of 150% of their terminal benefits or entitlements.

- The maximum tenor for the Salary Advance is 90 days (3 months), with a 30-day cleanup cycle.

- Quick Processing: within 2 working days of application, allowing for rapid access to funds when needed most.

- Competitive Interest Rates.

- Repayment period up to three (3) months, providing flexibility for employees to pay back the advance based on their financial situation.

- Interest is calculated on a reducing balance basis, ensuring that the interest charges decrease as the outstanding balance is paid down, making repayment more manageable.

B A N K

Salary Advance

Immediate Access To Cash

Our Salary Advance program is designed to empower employees of pre-approved organizations by providing them access to a portion of their salary before the official payday. This credit facility allows employees to meet urgent personal obligations, ensuring that they have the financial flexibility needed to manage unexpected expenses or planned financial commitments without delay.

-

Features & Benefits

-

Requirements

- A Request Letter or Application Letter/Form must be submitted to initiate the process.

- Proof of terminal benefits or entitlements, such as Provident Fund, Tier 2, or Tier 3 Pensions, is required.

- Employees must provide pay slips for the last 3 months to verify income and employment status.

- If the employee's salary has been channeled through OmniBSIC Bank for less than three months, a bank statement for the last 3 months is required to establish a payment history.

- Domiciliation Requirement:

- A default charge of 10% per annum applies to any overdue balance of principal and interest, ensuring accountability in repayment.

- An insurance charge of 1% of the principal amount will be applied, providing additional security for the loan.

- Customers should refer to the tariff guide for all other applicable charges that may be associated with the Salary Advance facility.

General Products & Services

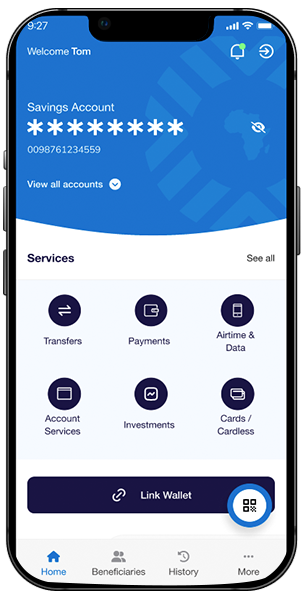

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I use four banks but OmniBSIC Bank is my favorite out of all four and I like all the feedback too. God should grant you more customers.”

“The Tellers, CSOs, and everyone at OmniBSIC Bank are exceptional. You bring a cheque, and they process it instantly. Need a transfer to another bank? They handle it within 30 minutes—no delays ”

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”

“So far, the experience has been fantastic, with excellent customer service. They greet customers with warm smiles, and the tellers are attentive and efficient, welcoming you with a friendly approach. It’s truly been amazing”

“The customer service is good and I recommend OmniBSIC Bank to everybody.”