- Quick access to funds requests up to GHS 1 million, with approvals typically granted within 48 hours ensuring rapid access to working capital.

- This facility is available for a standard tenure of up to 90 days, with exceptional cases eligible for an extension of up to 150 days, accommodating various business cash flow cycles.

- Invoices or certificates are discountable only if they are outstanding and have been fully accepted as valid for payment by an approved counterparty within six months from the date of issuance.

- This product is structured to minimize risk by requiring adequate tangible security, assessed at a minimum of 120% of the Open Market Value, in line with the bank's collateral standards.

B A N K

Receivable Finance

Cash flow when you need it most..

Our Receivable Finance is a working capital solution designed to provide immediate cash flow by purchasing debt owed to a business by approved counterparties. This facility helps businesses unlock cash from their outstanding invoices, allowing them to meet operational needs efficiently.

-

Features & Benefits

-

Requirements

- Acceptable Counterparties

- Invoice Verification:

- The invoice or certificate must receive confirmation from business managers before it can be discounted.

- Invoices or certificates must be payable within six months from the date of issue to qualify for the facility.

- A tripartite domiciliation agreement or an enforceable letter of undertaking must be in place among the customer, the bank, and the counterparty.

- Arrears Management

General Products & Services

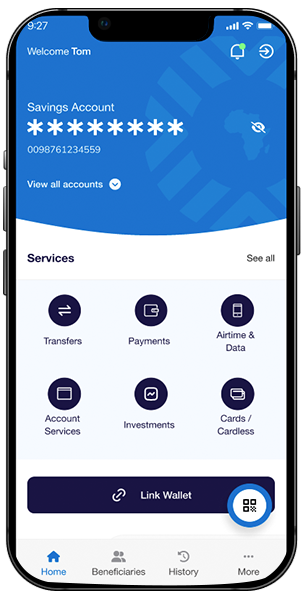

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I use four banks but OmniBSIC Bank is my favorite out of all four and I like all the feedback too. God should grant you more customers.”

“The Tellers, CSOs, and everyone at OmniBSIC Bank are exceptional. You bring a cheque, and they process it instantly. Need a transfer to another bank? They handle it within 30 minutes—no delays ”

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”

“So far, the experience has been fantastic, with excellent customer service. They greet customers with warm smiles, and the tellers are attentive and efficient, welcoming you with a friendly approach. It’s truly been amazing”

“The customer service is good and I recommend OmniBSIC Bank to everybody.”