- Up to 12 months Overdraft facilities providing businesses with a substantial time frame to manage their cash flow.

- Competitive Interest Rates

B A N K

Overdraft

Your safety net for unexpected expenses.

Our overdrafts are structured credit facilities that allow businesses to overdraw their current accounts within an approved limit to meet short-term working capital needs. This flexible financing facility enables businesses to access additional funds on demand, providing a financial safety net to manage cash flow fluctuations effectively.

-

Features & Benefits

-

Requirements

- Renewal Policy

- Processing Fee

- A processing fee of up to 3.5% may apply to the overdraft facility.

- A default charge of 10% per annum applies to any overdue balance of principal and interest, encouraging timely repayments.

- An early repayment penalty of 0.25% of the outstanding balance will be charged if the overdraft is repaid before the agreed-upon terms.

- An interest rate is set at GRR + up to 15%, ensuring a competitive cost of borrowing.

- A borrower must maintain an open current account with the Bank.

- Completed credit application forms are required for processing.

- A board resolution authorizing the overdraft must be provided.

- A minimum of 6 months of bank statements must be submitted to assess cash flow and financial stability.

- An investment plan showing the intended use of the overdraft funds must be provided. The bank can assist in the creation of this plan if needed.

- Financial statements for at least one year are required, with audited statements needed for corporate clients.

- A cash flow statement reflecting one year of historical data and a minimum of one year projected must be submitted.

- Adequate security or collateral must be proposed to secure the overdraft facility.

- Valid business registration documents must be provided as part of the application process.

- Customers should consult the tariffs guide for additional charges, fees, and commissions applicable to the overdraft facility.

General Products & Services

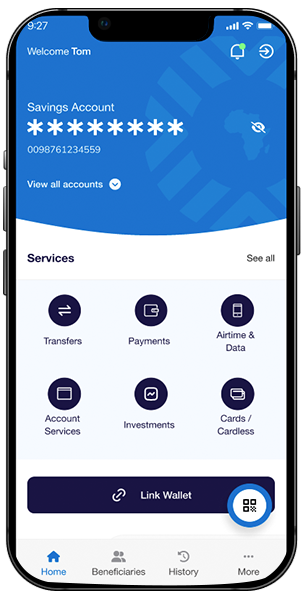

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I've been banking with OmniBSIC for over 10 years now, and I can honestly say it's been a fantastic experience. The staff is always friendly and helpful.”

“I've been banking with OmniBSIC for over 10 years now, and I can honestly say it's been a fantastic experience. The staff is always friendly and helpful.”