- Through Partnerships with Quality Developers, we ensure that borrowers are investing in properties built to last

- Borrowers are required to contribute only 20% of the mortgage value

- All loans are priced, disbursed, and repaid in Ghana Cedis.

- Our Home Loan offers a repayment tenure of up to 120 months (10 years), allowing borrowers to spread their payments over a manageable period that suits their financial circumstances.

B A N K

Home Loan (LCY, GBP, USD, EUR)

Supporting Dreams.

Our Home Loan product is specifically designed to simplify the process of homeownership for individuals and families. This credit facility enables borrowers to finance the purchase or construction of their homes with ease and affordability.

-

Features & Benefits

-

Requirements

- Mortgage Application Documentation

- A Minimum Equity contribution of 20% of the mortgage value is required at the time of application.

- A valid identification, such as a passport, driver’s license, or voter’s ID card.

- An official offer letter from the property developer or vendor is needed to proceed with the loan application.

- Current pay slips of 3 months submitted for income verification and repayment capacity.

- A Bank statement for the last 6 months is required to assess their financial behaviour.

- A utility bill or other documentation is required as proof of residence, ensuring compliance with standard KYC (Know Your Customer) documentation.

- An undertaking from the employer to channel salaries through OmniBSIC Bank

- A mandatory valuation report is conducted by an OmniBSIC Bank to establish the market value of the property.

- Property Title and Commission Search:

- Land Deed of Assignment:

- Building Documentation (Bill of Quantities, Building Plan, and Building Permit.

- A default charge of 10% per annum on any overdue balance of principal and interest will be applicable.

- An early repayment penalty of 0.25% of the outstanding balance will be charged if the loan is repaid before the due date.

- A mandatory insurance charge of 1% of the principal amount will apply to safeguard the loan against unforeseen circumstances.

- Borrowers should refer to the tariffs guide for information on other applicable charges, fees, and commissions related to the Home Loan.

General Products & Services

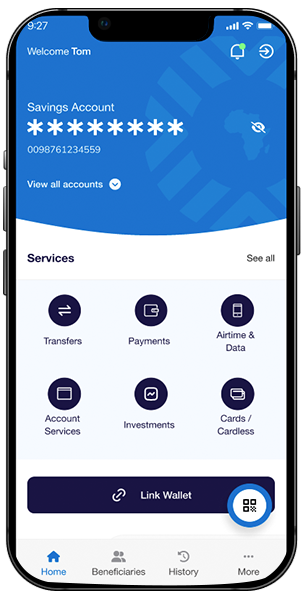

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”

“So far, the experience has been fantastic, with excellent customer service. They greet customers with warm smiles, and the tellers are attentive and efficient, welcoming you with a friendly approach. It’s truly been amazing”

“The customer service is good and I recommend OmniBSIC Bank to everybody.”

“I use four banks but OmniBSIC Bank is my favorite out of all four and I like all the feedback too. God should grant you more customers.”

“The Tellers, CSOs, and everyone at OmniBSIC Bank are exceptional. You bring a cheque, and they process it instantly. Need a transfer to another bank? They handle it within 30 minutes—no delays ”

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”

“So far, the experience has been fantastic, with excellent customer service. They greet customers with warm smiles, and the tellers are attentive and efficient, welcoming you with a friendly approach. It’s truly been amazing”

“The customer service is good and I recommend OmniBSIC Bank to everybody.”

“I use four banks but OmniBSIC Bank is my favorite out of all four and I like all the feedback too. God should grant you more customers.”

“The Tellers, CSOs, and everyone at OmniBSIC Bank are exceptional. You bring a cheque, and they process it instantly. Need a transfer to another bank? They handle it within 30 minutes—no delays ”

“I joined the bank a few months ago but I’m satisfied with the services. When I need money I come and everything is on point. I love the bank and I have no regrets.”