close

O

m

n

i

B

S

I

C

B A N K

B A N K

News & Blog

Corporate Banking

General Products & Services

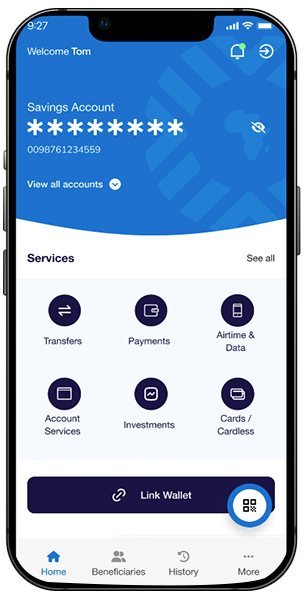

Mobile App

Download the Fastest and Secure Mobile Banking App

Take control of your finances anytime, anywhere with the secure and convenient OmniBSIC Mobile App

Testimonials

Love from Happy Clients

Our Customers Can't Stop Talking About Us

“I've been banking with OmniBSIC for over 10 years now, and I can honestly say it's been a fantastic experience. The staff is always friendly and helpful.”

“I've been banking with OmniBSIC for over 10 years now, and I can honestly say it's been a fantastic experience. The staff is always friendly and helpful.”