It is an endowment plan to enable our customers to build wealth to achieve their short to medium-term goals in life.

Features & Benefits

Sum assured indicated at inception of policy is fully paid at maturity of policy

An opportunity to place funds in an annuity if one is not in need of funds at maturity.

The minimum policy term is 4 years and the maximum is 10 years.

In case of Total Permanent disability, 50% of sum assured is paid to the policyholder.

Policy can be used as collateral for loan facilities.

Prompt payment of all legitimate claims.

In case of accidental death e.g. motor accident, the claim is paid immediately irrespective of how long one has signed on to the policy.

Eligibilty Criteria

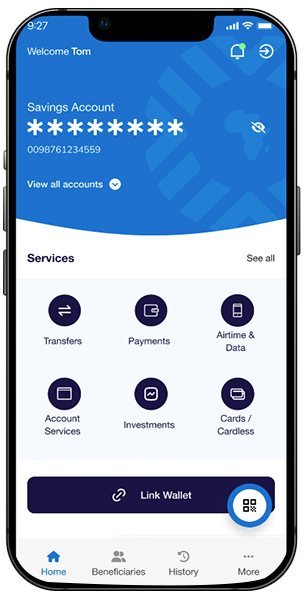

One must be an account holder with OmniBSIC Bank and above 18 years.

Valid National ID card.